MOScholars was established by the Missouri General Assembly in 2021 to provide educational opportunities and resources to Missouri students and families. The program provides options

for eligible families, allowing them to seek an array of alternative educational services ranging from private schools to therapeutic services.

The law provides state tax credits for contributions to approved, non-profit Educational Assistance Organizations (EAOs). These EAOs use the contributions to award scholarships to Missouri

students with Individual Education Plans (IEPs) and students living in low-income households.

|

(Returning users must have confirmed your registration through the email, sent to you when you registered, before you can successfully log into the Parent Portal.)

|

|

|

|

Per statute, a qualified student must meet requirements established by Missouri Revised Statutes 166.700(9).

|

|

Qualified students must also meet one of the following criteria:

|

- Have an approved “individualized education plan” developed under the federal Individuals with Disabilities Education Act (IDEA). The term “individualized education plan” means an individualized

education program (IEP) as defined in 20 U.S.C. §1414(d)(I)(A)(i). Students with ISPs that are not developed under the IDEA are not eligible.

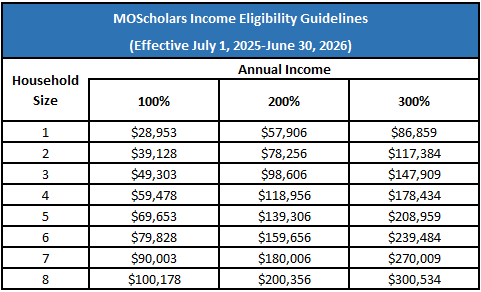

- Is a member of a household whose total annual income does not exceed an amount equal to 300% of the income standard used to qualify for free and reduced lunches, and meets at least one of the following:

- Attended a public school as a full-time student for at least one semester during the previous twelve months; or

- Is a child who is eligible to begin kindergarten or first grade; or

- Is a sibling of a qualified student who received a scholarship grant in the previous school year and will receive a scholarship grant in the current school year.

|

|

Income eligibility guidelines are determined annually by the federal government. You can find that information here.

|

|

|

|

How to Apply to MOScholars

|

| |

|

Click here to learn how to apply as a student.

|

|

Scholarships may be used on the following:

|

- Tuition and fees at a qualified school;

- Textbooks required by a qualified school;

- Educational therapies or services from a licensed or accredited practitioner or provider including, but not limited to, licensed or accredited paraprofessionals or educational aides;

- Tutoring services;

- Curriculum;

- Tuition or fees for a private, virtual school located in Missouri;

- Fees for a nationally standardized norm-referenced achievement test, advanced placement examinations, international baccalaureate examinations, or any examinations related to college or university admission;

- Account Transaction fees;

- Services provided by a public school including, but not limited to, individual classes and extracurricular programs;

- Computer hardware or other technological devices that are used to help meet the qualified student’s educational needs and that are approved by an educational assistance organization;

- Fees for summer education programs and specialized after-school education programs;

- Transportation costs for mileage to and from a qualified school.

|

|

Scholarships may not be used on the following:

|

- Consumable educational supplies included, but not limited to, pens, pencils, paper, markers;

- Tuition at a private school outside the state of Missouri;

- Payments or reimbursements to any person related within the third degree of consanguinity or affinity to a qualified student.

|

- Eligible expenses include:

- Tuition and fees at a qualified school;

- Textbooks required by a qualified school;

- Educational therapies or services from a licensed or accredited practitioner or provider including, but not limited to, licensed or accredited paraprofessionals or educational aides;

- Tutoring services;

- Curriculum;

- Tuition or fees for a private, virtual school located in Missouri;

- Fees for a nationally standardized norm-referenced achievement test, advanced placement examinations, international baccalaureate examinations, or any examinations related to college or university admission;

- Account Transaction fees;

- Services provided by a public school including, but not limited to, individual classes and extracurricular programs;

- Computer hardware or other technological devices that are used to help meet the qualified student’s educational needs and that are approved by an educational assistance organization;

- Fees for summer education programs and specialized after-school education programs;

- Transportation costs for mileage to and from a qualified school.

- Scholarships may not be used on the following:

- Consumable educational supplies included, but not limited to, pens, pencils, paper, markers

- Tuition at a private school outside the state of Missouri

- Payments or reimbursements to any person related within the third degree of consanguinity or affinity to a qualified student

|